by wemakedo | Feb 27, 2018 | money, transport |

We had been nursing a very old car along for 15 years until it recently expired with a whimper. My most recent “fix” was to drill holes in the floor to let out the water that it had been accumulating, so its days of useful service were numbered.

To be honest the car was already 8 years old when we bought it making it one of the oldest things I’ve seen on the road at 23 years of age when it finally had enough. They just don’t make them like they used to..this thing had never had its clutch changed or touched in any way and after 23 years of service, the clutch finally wore out.

Our 1995 Micra was dead – or at least a clutch replacement didn’t seem worth the cost to us.

Moving on, we figured we would at least give some thought as to how we might manage on a single car. But with three young school going kids and living in the country this proved to be very difficult. In the end, it was simply too difficult for us to manage all the demands and we decided that our best option was to limit the harm we would do with our next vehicle over its life – the obvious answer here is an electric car (or EV – Electric Vehicle).

We looked for and found a 2013 electric Nissan Leaf and decided that was the way to go.

For a second car we didn’t want to splash out, firmly believing that cars are about function rather than looks. More of an unfortunately necessary waste of money and a highly depreciating asset as well, than a pleasurable investment.

Browsing the relevant websites brought back those familiar feelings of how much the car dealers profit from used car sales and how private sales offer good value if you can evaluate the car to your satisfaction.

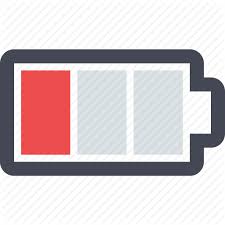

The interesting thing about purchasing a used EV from a private seller is that relative to combustion engine cars, these cars have very little that can go wrong. The state of the battery is the obvious main concern, but really they are a considerably lower risk purchase to make than a standard car with so much unseen mechanics that can go wrong. How would you ever know if a clutch was about to go? Does it burn oil? Are the engine gaskets in good shape? Did the timing belt really get changed?

Not on an EV – it doesn’t have such hidden liabilities.

The EV will display its travel range to you and although apparently, it may be possible to tamper with this, there is a nice cheap app that you can use, along with an OBDII code reader to query the car and see the true battery lifetime (in AmpHrs) remaining. So you can know exactly what you are buying, and decide if you can live with that range.

In truth, there seems to be excellent value to be had now in second hand EVs due to the fear associated with used batteries.

Yes, the batteries, of course, will degrade over time and usage and the range consequently drops off. But if you need more than 90 or 100kms daily range then one of these is not for you anyway. But with national daily average mileage at about 27 to 30 miles, then these used EVs can suit many people’s driving habits. But thankfully for us, the uncertainty in buyers minds and the aversion to having to manage your range closely means that second-hand EV prices represent great value.

So we bought it – €7300 euros for a 131 car with 60k km on the clock and 11 of 12 bars range showing.

This particular model had some of the improvements that Nissan made on the original 2011 Leaf design, but still some of the drawbacks. It had the lower capacity 24Kwh battery pack and it also still had a resistive heater which consumes significant power from the battery during cold weather, unlike the newer models which use a heat pump. Considering this and the fact that it had 11 of 12 bars battery capacity remaining we were delighted to spend that to get a nearly new car.

My introduction to driving an electric car, however, was not pleasant.

I bought the car in North County Dublin and planned my drive back to Cork. A few things I learned the hard way:

Dublin has many fast charge points which include the charging cable. When you buy a car that only has a “granny cable” – that is one that plugs into a regular household socket for slow charging – then you are S.O.L. when you pull into one of the many charge pints that require you to have the custom cable/connector. Picture my smile fading as I found my first charge point well outside Dublin with 15 km range left only to realise it didn’t have any connector. Nor did I.

After the new understanding of how this worked settled in and the panic subsided, I realised I had enough in “the tank” to barely make it to the next charge point which did include a connector. I began to realise that my charge point options were now very limited without a cable.

To be fair the infrastructure in Ireland is good, and once you understand the different types of charge points and carry the right cable, getting around over long distances is easy although time-consuming when you factor in the charging time.

On that trip, however, I also learned that a very cold and windy day will significantly impact your range due to wind resistance and if you decide to run the heater to warm yourself. I watched in horror after charging up to the max as the kilometre range value predicted by the car started dropping as I drove along, dropping a lot faster than the kilometres I was covering on the ground.

And so at the height of my misery on that cold Friday night in February, as I huddled in the freezing car at 11:30 pm in a deserted garage forecourt waiting for the nice Nissan breakdown recovery people to find me, with only 10km range left but no charger-point within range – these simple points were becoming well understood:

• Don’t drive so fast on the motorway!

An EV is best driven conservatively on the open road, that is to say, 95 to 100km/hr will deplete your battery a lot faster than 85km/hr.

• Turn off the heater until you really need it!

• Use “economy mode” driving for longer journeys to maximise your range

• Pay attention to the charge point information and which kind of charger you are aiming to stop at, they are not all the same.

I’m sure this information is pathetically obvious to experienced EV drivers as it is to us now having learnt the hard way. But when you are caught up in the buying frenzy, don’t forget to realise that driving an EV is a very different experience to the heedless driving we are all accustomed to in gas guzzling cars with fuel stations everywhere.

You may have heard the EV related phrase known as – “range anxiety” which newbies experience as they learn to manage their electric car’s needs. It’s real!

You may have heard the EV related phrase known as – “range anxiety” which newbies experience as they learn to manage their electric car’s needs. It’s real!

But it’s treatable with some experience and practice.

I was traumatised by my first long journey experience in a car that should not have been used to cross half the country on a freezing, windy Friday night with no suitable charge cable and a steep learning curve ahead for its new owner.

But now that we understand the range limits and use the car accordingly, we love our electric car and highly recommend them. It recently made the trip to Dingle, covering 135kms with a top up in the middle.

Making that journey was like getting back up on that bike that gave you your first bad fall. That trip repaired the trust and now we’re on the best of terms with our trusty EV. Second hand, the Nissan Leaf is a good value option for households that prefer to own a second car. We highly recommend you consider one if you are in the market for a new car.

by wemakedo | Feb 6, 2018 | family, money, reuse |

The way Christmas unfolds in Ireland seems to bring conflicting emotions with it. We, like most parents, like to bring some “magic” to the occasion for our children, but it’s a real struggle to do this without feeling like one is on a slippery slope of wanton waste and mindless consumerism. Having been out of the country for several previous Christmas periods, this year we were exploring how we wanted Christmas to feel in our home. It started well with some intentions to engage the kids in some acts of giving each week in the run-up. We didn’t want them to start believing the whole thing is just about the gifts and “what’s Santa bringing you?”.

The amount of times well-wishers will ask kids this question during December is staggering and somewhat irritating. How could children who hear this refrain repeatedly, think about anything else other than their list of stuff and what they are entitled to?? We seem to be hell-bent on spending a month every year teaching them to want things!! Toy companies must be so proud of how well we’ve all bought into this!

Anyway, in the end, we got suckered in; we absorbed the “Late-Late Toy show”, visited more than one “winter wonderland experience”, bought the “Elf on the Shelf” and had our vague good intentions swept aside, and we pretty much signed up for the whole consumerist shebang. Plastic battery operated toys were purchased in spades based on the aforementioned critical Santa “list” and our Christmas morning turned into a whole lot of stuff strewn about the house with the kids obviously confused by the quantity and what to do next with it all. It doesn’t take long before this is the norm and expectations are set for future Christmas’s to come.

We did at least try to use fabric to wrap the stuff under the tree which worked well, but there was no doubt that the whole event was too much about the purchases despite some vague earlier intentions to inject some other values into the occasion and try to give it a broader meaning. The whole idea of teaching kids to be good so that they can get more stuff from Santa on Christmas day seems like such an outdated lesson to giving our children. What natural conclusions would young minds draw from this as they see it played out year after year at Christmas time? It’s a very self-interested and greed-inducing message to give. Isn’t it time we moved on from this?

We did at least try to use fabric to wrap the stuff under the tree which worked well, but there was no doubt that the whole event was too much about the purchases despite some vague earlier intentions to inject some other values into the occasion and try to give it a broader meaning. The whole idea of teaching kids to be good so that they can get more stuff from Santa on Christmas day seems like such an outdated lesson to giving our children. What natural conclusions would young minds draw from this as they see it played out year after year at Christmas time? It’s a very self-interested and greed-inducing message to give. Isn’t it time we moved on from this?

Something that struck us as we look back on Christmas 2017 is that if you want to do something a little different with the occasion, then you really have to know what you want to get from it and be proactive in your efforts to go after it. Somewhat unclear intentions of trying different things may get overwhelmed in the surge of messages that bombard us all. In a small country like Ireland, “the way things are done” can be a powerful current to swim against.

The Community Reuse Network of Ireland is running a campaign in January which encourages us to re-gift and pass on the unnecessary stuff we have accumulated. Hoarding stuff that we don’t need or use is a sure way to clutter your life. It’s wasteful too, at a time when the world is producing too much. This campaign is encouraging people to “Think a bit differently about January and see it as a month of giving back and decluttering – giving unwanted presents to charity shops, sharing decluttered items on Free trade sites and recycling any unwanted holiday waste and electrical goods”.

Note that the Babymarket.ie is continuing to offer a great way to sell your used child-related items and to help new parents to save some money.

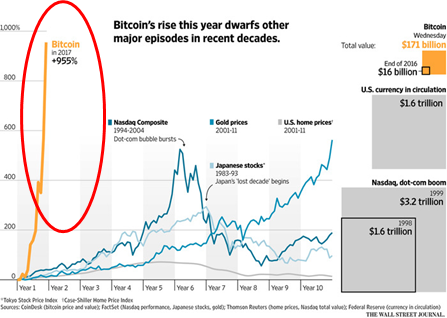

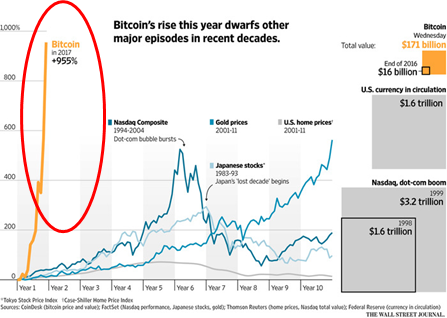

We also spent the month of December (and November, and October…) glued to the price of Bitcoin. It’s a digital currency or “cryptocoin” that has been in operation since 2010 and has recently become more widely known.

We also spent the month of December (and November, and October…) glued to the price of Bitcoin. It’s a digital currency or “cryptocoin” that has been in operation since 2010 and has recently become more widely known.

You may have seen the news stories late last year as this niche technology captured much wider interest and began to be covered extensively in the media due to its massive gains in value (see the plot shown indicating the exponential rise in value that took place as compared to other asset bubbles).

Having followed it for a few years we decided to buy a very small amount of Bitcoin in September 2017 and were fortunate to experience some of the recent massive surge in value it experienced last year. Huge levels of new interest in this digital currency with only 16 million units in circulation, led to a price increase from approximately $3500 per coin in September to nearly $19,000 in December. It has since crashed back down to $8,000 though and still dropping. But such are the dizzying highs and lows of crypto-coin speculation.

It is interesting to watch the varied commentary when something like this happens. On the one hand, there are those who have bought into this vision of the future and see Bitcoin (and other cryptos) as a future “currency of the people” and say it will soon be worth hundreds of thousands of dollars per coin. A universal currency that is not controlled or manipulated by banks or governments has a certain appeal for lots of reasons.

On the other hand, there are those who represent the established banking industry or government regulators who are making dire predictions of a total collapse of this absurd speculative bubble based on a meaningless creation.

The truth about Bitcoin and other digital currencies is probably likely to be somewhere in between these two extreme predictions. There is enough interest in the technology that there seems to be no doubt it will survive in some form.

As with all disruptive technologies, there are incumbents who are unsettled by its potential and have much to lose when their own industry is threatened…i.e. bankers and government regulators. While those first movers who believe in the technology will vastly exaggerate its potential in order to drive others to get on board.

The argument that Bitcoin is in reality worthless seems strange as, so are all currencies (pieces of paper after all) except that governments back them and give them value. Hence you know your paper Euro has value, but we also know what happens when governments collapse and currencies devalue extraordinarily as is currently happening in Venezuela. This does happen and suddenly a currency can become near worthless when the trust breaks down.

As something like Bitcoin gains acceptance then it will of necessity gain intrinsic value from those who believe in it and are willing to transact it and assign value. The problem, for now, is, of course, its volatility. It’s getting harder for people to sign up to use it when its price is moving by so much and so quickly.

The counter-argument made in favour of Bitcoin is that while unlikely to replace regular currency, it represents a new way to store value in the place of gold. Not that many of us tend to buy gold these days to store value, but you get the idea. If Bitcoin can be readily purchased by anyone with a pc and stored safely (this may be an issue) and it keeps or grows in value over time, then it represents an improvement over gold.

The obvious comparison to make here is to the buying of company stock. When you buy stock in a company, you are investing in the future growth potential of that company. So when your investment goes up, is it because some tangible economic value has been delivered by the people in that company and so you are sharing in the increased company worth as your stock goes up. This doesn’t really apply to the crypto asset class, however, as there is currently no obvious intrinsic value to use in order to figure out if its price is reasonable or which direction it’s likely to go. Hence it is for now pure speculation and everyone buying it is hoping that they are not the last buyers. Hence it is very very volatile and very unpredictable, but this is not unusual for such a disruptive new technology.

It is certainly an interesting phenomenon that is in the very early stages of its development. We have decided to ride out the volatility with our little investment to

see where this all goes. Remember the Internet in the late 90’s when many apparently silly ideas with a “dot com” attached to their names would surely change our lives dramatically in the future, and these ideas were driving massive speculation in stock markets prices. And then it all burst in the economic crash of 2000. With hindsight, we can now see how that has played out after all the crushed dreams and silliness are gone.

see where this all goes. Remember the Internet in the late 90’s when many apparently silly ideas with a “dot com” attached to their names would surely change our lives dramatically in the future, and these ideas were driving massive speculation in stock markets prices. And then it all burst in the economic crash of 2000. With hindsight, we can now see how that has played out after all the crushed dreams and silliness are gone.

Yes, it was a bubble, but yes the technology did change the world dramatically once people figured out the true value in it.

There may be something to this Bitcoin thing.

Watching this Bitcoin story unfold in December certainly added a different angle to the Christmas cheer in our house: while kids were drooling over the latest toys that might make the Christmas list, Dad (at least) was drooling over the surge in Bitcoin value.

But then the hangover set in..

by wemakedo | Nov 11, 2016 | money |

A large part of our WeMakeDo philosophy is removing waste from our lives and building in self sufficiency where we can, mostly because of the satisfaction it brings but also because of the cost savings. We want to have a low-cost life and have set the goal for ourselves to live on 30-35k per year for our family of 5 while still living as well as we want to. This is in part so that we don’t have the constant pressure of having to make lots of money to live as we choose but more-so because it just removes a lot of the hassles from our lives that tend to come from extravagant spending. Putting it another way – breaking the cycle of needing lots of money to feed consumption habits that lead to lots of stuff and hassle that then requires more money and time to maintain.

With this approach in mind it makes a lot of sense to have your money work hard when it’s not being spent and so we have spent a lot of time and effort examining the options available to make your saved money work for you and provide some useful income

In this post we wanted to share three topics:

- A must read blog from a person in the US who has successfully designed his family lifestyle to allow him to retire at age 30 and to live how he wants on $25k per year which comes from interest on his savings if he chooses not to earn money with his time.

- 2 options you may not have heard about if you have savings that need to do some more work with a little risk.

The blog..

An online hero of ours had been writing about his life choices for over 4 years now and these choices have allowed him to retire from salaried life at age 30 with his wife and child and he is now over 12 years on this path. It’s important to note that it was never his intent to sit around and do nothing, but instead to control his finances in a way that allowed him to have the freedom to choose how he spent his time doing when not forced to follow a salary. He writes excellently about how he has achieved this through removing unnecessary spending from his life while making his saved money work, all the while leading the satisfying life that he wants to live without earning a salary. Unless one starts adopting this approach early in life, achieving his outcomes are not easy, but there is plenty to take from this philosophy of not consuming wastefully and taking control of ones finances : check out the story here www.mrmoneymoustache.com or alternatively you can watch Pete (Mr Money) describe his lifestyle at this excellent talk from the World Domination Summit.

The savings growth options..

In the current low interest times, savings are no longer a worthwhile option, as the paltry rates are nowhere close to inflation and so money in banks although somewhat protected from wasteful urges is not exactly working. The problem is that the only other way to have your savings grow is to subject them to risk at varying levels. The stock market is the most well known vehicle for putting money to work with different levels of risk involved. With global interest rates as low as they are, big investor money is chasing one of the few places to still make money through stocks which has had the effect of driving US markets to all-time highs. The US markets have returned to the peaks they reached before the crash in 2007/2008 and now fear is beginning to return as people wonder how much longer this can continue with some economies on shaky ground in places like Europe and China. One way to still take part but to minimize the risks is to buy into funds that are spread across broad areas of the market and to do this in an automated way over a longer term which aims to take advantage of the general upward trend of markets.

Roboadvisors: These are a new breed of money management companies that have simplified and automated the process of making your money work in stocks and funds with very low fees. These Robo-advisor companies will manage your money and use it to buy into funds where you specify the risk level you are happy with. They automate the process of adjusting your investments to take account of changes in the risk levels of different assets and do this rebalancing using algorithms which work without your involvement. They will also manage the reinvestment of dividends and income. The nice thing about this service is that you don’t have to spend time watching and fretting about whether it’s invested in the right place, and historical evidence has shown that if you buy in and hold over the long term, the stock markets are always going up despite crashes of varying sizes along the way. Data shows that for US markets at least, the average annual return is approximately 7% over the longer term (10% before taking account of inflation). Thus buying and holding using these automated services looks very attractive and our friend MrMoneyMoustache has plenty of data on his site showing the performance of his investments using one of the better known US Roboadvisors. The UK equivalents do pretty much the same thing. I plan on investigating these more with a view to jumping in. We’ll report back if we do.

Some noted options:

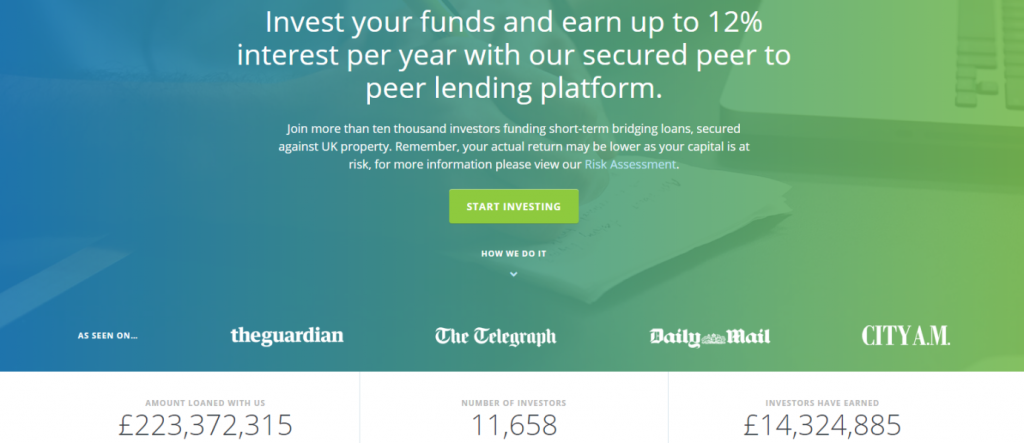

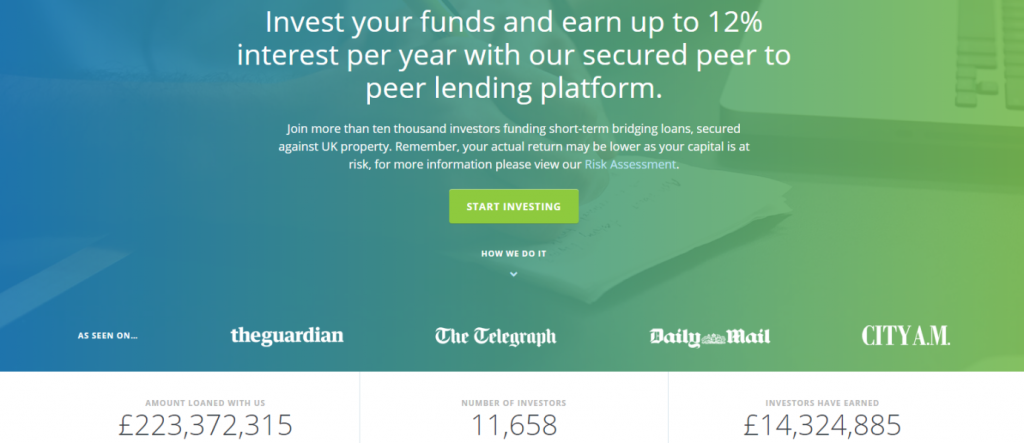

Peer to Peer (P2P) Lending: This is a relatively recent addition to the “sharing economy” and is a service which makes use of peoples willingness to lend their money to borrowers in conditions where banks might not want to lend. In some cases this can be because the borrowers are considered too risky but in other cases it may be too short duration with too high a loan to value ratio. These companies pay their lenders well for putting up with the risk. One such example I have dabbled in is : www.Savingstream.co.uk.

These guys will pay you 12% interest per year on money that is used to make up short term loans for properties and development projects. They say they have a rigorous vetting process to make sure they only take on borrowers with low risk of defaulting. But be warned: if a borrower does default, then the money you have invested which part funded this loan may be at risk, although the model allows for the sale of the asset to be used to recoup the loan for investors and since 2013 this particular company has a 100% record in repaying the loans.

It’s not a place for alot of your long term savings but certainly can be considered as an easy way to generate some very good income on savings with a reasonably low level of risk.

At some future point we will update on how our income experiment with this company is going.

You may have heard the EV related phrase known as – “range anxiety” which newbies experience as they learn to manage their electric car’s needs. It’s real!

You may have heard the EV related phrase known as – “range anxiety” which newbies experience as they learn to manage their electric car’s needs. It’s real!

We did at least try to use fabric to wrap the stuff under the tree which worked well, but there was no doubt that the whole event was too much about the purchases despite some vague earlier intentions to inject some other values into the occasion and try to give it a broader meaning. The whole idea of teaching kids to be good so that they can get more stuff from Santa on Christmas day seems like such an outdated lesson to giving our children. What natural conclusions would young minds draw from this as they see it played out year after year at Christmas time? It’s a very self-interested and greed-inducing message to give. Isn’t it time we moved on from this?

We did at least try to use fabric to wrap the stuff under the tree which worked well, but there was no doubt that the whole event was too much about the purchases despite some vague earlier intentions to inject some other values into the occasion and try to give it a broader meaning. The whole idea of teaching kids to be good so that they can get more stuff from Santa on Christmas day seems like such an outdated lesson to giving our children. What natural conclusions would young minds draw from this as they see it played out year after year at Christmas time? It’s a very self-interested and greed-inducing message to give. Isn’t it time we moved on from this?

We also spent the month of December (and November, and October…) glued to the price of Bitcoin. It’s a digital currency or “cryptocoin” that has been in operation since 2010 and has recently become more widely known.

We also spent the month of December (and November, and October…) glued to the price of Bitcoin. It’s a digital currency or “cryptocoin” that has been in operation since 2010 and has recently become more widely known.

see where this all goes. Remember the Internet in the late 90’s when many apparently silly ideas with a “dot com” attached to their names would surely change our lives dramatically in the future, and these ideas were driving massive speculation in stock markets prices. And then it all burst in the economic crash of 2000. With hindsight, we can now see how that has played out after all the crushed dreams and silliness are gone.

see where this all goes. Remember the Internet in the late 90’s when many apparently silly ideas with a “dot com” attached to their names would surely change our lives dramatically in the future, and these ideas were driving massive speculation in stock markets prices. And then it all burst in the economic crash of 2000. With hindsight, we can now see how that has played out after all the crushed dreams and silliness are gone.